Taxes

VAT small business owner

Particularly at the beginning of self-employment, it can make sense to make use of an option known as "VAT small business". According to Section 19 UStG, you can choose not to show VAT on your invoices if your turnover was less than EUR 17,500 in the previous year and is not expected to exceed the EUR 50,000 mark in the current year. Consequently, if you have already turned over EUR 40,000 in the first six months and then "take a break" for six months (go on vacation), you would exceed the EUR 50,000 mark.

The advantage of being a small business for VAT purposes is that you do not have to pay this unreported VAT to the tax office. However, the disadvantage is that the photographer cannot then reclaim the input tax paid by him (VAT included in the purchase invoices, for example for a camera purchase) from the tax office.

If you mainly have private customers and do not need to make any major investments, it makes sense to operate as a "small business for VAT purposes". In this way, you either make more profit than your competitors (exactly 19% more, assuming the same cost structure), or you are able to significantly undercut your competitors in terms of price. This would have the advantage of attracting further demand.

Example 1:

Career starter N. Eu has detailed plans for his first year of work. In his first year of self-employment, he plans to buy camera equipment for EUR 8,000 (including VAT) and a computer and accessories for EUR 2,000 (also gross). His expected income in his first year of self-employment will amount to EUR 12,000 (also gross). He will generate this income by only taking portraits and wedding photos of private individuals.

Question 1: Does it make sense for him to operate as a small business for VAT purposes or should he opt for VAT?

Invoice 1a:

N. Eu decides to operate as a small business for VAT purposes. His profit is 12,000 euros (income) - 10,000 euros (expenditure) = 2,000 euros (profit before income tax).

Calculation 1b:

N. Eu decides to show the VAT in his invoices so that he can also have the input tax refunded in the incoming invoices. The profit calculation is as follows: EUR 1,596.64 input VAT paid (included in the invoice amount of his purchases) - EUR 1,915.97 VAT collected (he has invoiced his customers) = (-) EUR 319.33 (this is his VAT payable). He must pay this difference of EUR 319.33 to the tax office. His expenses therefore amount to: EUR 8,403.36 (net expenses), plus VAT payable (EUR 319.33) = EUR 8,722.69. His income: 10,084.03 euros (net income). Profit = 1,361.34 euros.

Answer 1: It makes more sense for him to operate as a small business for VAT purposes.

Example 2:

Career starter N. Eu has detailed plans for his first year in business. In his first year of self-employment, he plans to buy camera equipment for 8,000 euros, a flash system for 3,000 euros (both including VAT) and a computer and accessories for 2,000 euros (also gross). His expected income in the first year of his self-employment would still amount to EUR 12,000 (also gross). He earns this by only taking portraits and wedding photos of private individuals.

Question 2: Does it make sense for him to operate as a small business for VAT purposes or should he opt for VAT?

Invoice 2a:

N. Eu decides to operate as a small business for VAT purposes. His profit is 12,000 euros (income) - 13,000 euros (expenditure) = -1,000 euros (loss).

Calculation 2b:

N. Eu decides to show the VAT in his invoices so that he can also have the input tax refunded in the incoming invoices. The profit calculation is as follows: EUR 2,075.63 input tax paid (included in the invoice amount of his purchases) - EUR 1,915.97 VAT received (he has invoiced his customers) = (+) EUR 159.66 (this is his VAT receivable from the tax office). The tax office must refund him this difference of 159.66 euros. His expenses therefore amount to: 10,924.37 euros (net expenses). His income: 10,084.03 euros (net income) plus VAT refund (159.66 euros) = 10,243.69 euros. Loss = 680.69 euros.

Answer 2: In the 2nd case, it makes more sense for N. Eu to opt for VAT, as his loss is reduced in this way.

The question of whether one should act as a small business for VAT purposes can therefore only be answered if one knows the customer base and the investment behavior of the newcomer.

In a direct comparison between a portrait photographer who is a small business subject to VAT and a competitor who has to declare and pay VAT (with an otherwise identical cost structure), the former has the advantage of either making more profit or being able to offer lower prices than his competitor (and thus possibly draw some of his competitor's customers away from him). Provided that both have little or no expenditure (hardly invest in new purchases) and the customer base consists of private individuals who, as end consumers, cannot have any VAT included in the invoice price refunded.

However, as more is often invested than is earned, especially at the beginning of self-employment, newcomers with large investment requirements, including photographers, are generally better off opting for VAT. However, you are then bound to this decision for 5 years (Paragraph 19(2) UStG).

If you have to make a lot of purchases in the first few years of self-employment (flash equipment, props, camera equipment, computers and software, etc.) and work primarily for companies, it is advisable to opt for VAT. However, you are then bound to this decision for 5 years (Paragraph 19(2) UStG).

However, if you have already purchased camera equipment, flash system and accessories before starting your own business, i.e. only plan a few new purchases in the first few years and also mainly have private individuals as customers, it would make sense to operate as a small business for VAT purposes at the beginning. If you have done everything correctly, you will certainly exceed the turnover limit of 17,500 euros after 1-2 years, so that after another year (where you have to stay below 50,000 euros turnover) you will no longer have any freedom of choice and will have to report and pay VAT as normal and reclaim it from the incoming invoices from the tax office.

The question of the correct tax rate

The question of whether 7% or 19% VAT should be added to the (net) invoice total generally causes confusion. However, the procedure is not that complicated. If photos or ancillary costs dominate the invoice total, 19% is used. If, on the other hand, the focus is on the granting of usage rights, 7% is used.

If you create photos for private individuals, 19% is always used as the VAT rate. This 19% VAT must be included in the price you quote to your customers; the VAT must not be added afterwards.

If you provide a photo for publication in a magazine, you grant the publisher the right to use the photo. The same applies to uses such as: Printing as a postcard, poster or on coffee mugs, publication on the Internet in an online gallery, use as a background photo in a catalog design, etc. The granting of rights of use means that 7% must be used as the tax rate for VAT in your (outgoing) invoice.

When dealing with commercial customers, it is customary to use net prices when negotiating contracts. If you have agreed on an amount of EUR 1,000 for a photo shoot, for example, VAT must then be added to this amount. However, remember to show the VAT and the tax rate used separately on the invoice.

However, there are also cases where the main part of the invoice amount is not based on the granting of rights of use, but a complex shoot with many participants (assistants, models, make-up artists, stylists, set designers, etc.) and other extensive items (e.g. catering, travel expenses, hotel accommodation, props, etc.) are invoiced. In this case, you would not use the 7% VAT rate when invoicing, but 19%. Or you could write two different invoices: one for the ancillary and production costs and a second for the granting of usage rights. This option is also conceivable.

Value added tax

Regardless of the amount of VAT owed, newcomers to the profession must submit their advance VAT returns monthly (!) in electronic form by the 10th of the following month during the first two years of their self-employment. The program required for this, which is also used to transmit data to the tax office, can be downloaded from www.elster.de (ELSTER = ELektronische STeuerERklärung). On the homepage, click on "ElsterFormular", on the following page click on "Download ElsterFormular for 2010/2011>>".

The handling is very simple: You only have to enter the sum of your net income (income without VAT; broken down by tax rates) in the form (in addition to your tax number, name/company name, address and pre-declaration period); the program then calculates the VAT collected. Now all you need to do is enter the total VAT paid (your input tax) in the appropriate field and the program will calculate the "remaining VAT prepayment".

If you have invested more than you have earned (or more precisely: if you have spent more input tax than you have earned in VAT), you will be refunded the excess input tax paid by the tax office. In this case, you should of course not wait until the 10th of the following month to submit your advance VAT return, but do so at the earliest possible date.

Example: If you invested €5,000 (gross) in a new flash system in the relevant period (input tax paid = €798.32) and only received €2,000 for family and wedding photos in the same period (VAT received = €319.33), you will be refunded the difference = €478.99 by the tax office based on your advance VAT return.

After the program has determined the "remaining advance VAT payment" (or the difference that you have paid too much VAT and which you will now be refunded by the tax office), all you have to do is submit the advance VAT return to the tax office via the Internet and print out the resulting transmission protocol and keep it as a precaution.

The VAT return (for the whole year) then only serves to summarize the whole thing and to give the tax debtor the opportunity to make corrections (for example, if receipts have been forgotten or you have miscalculated). As the VAT return is made together with the income tax return after the financial year for the entire period (1 year), it is not at all unlikely that the values need to be corrected.

Income tax

In order to be able to prepare a complete income tax return (and it doesn't matter whether you or a tax consultant takes on this task), you need to keep a conscientious record of your income and expenses throughout the year. As a freelance photographer, you are required by law to keep a simple income statement, which in simple terms means that you deduct your expenses from your income in order to determine your operating profit.

In order to record your income in full, it is best to create a folder containing your outgoing invoices in numerical order. For your outgoing invoices, you will have to work with the "consecutive invoice number" anyway (see tutorial How do I do my first photo job professionally, efficiently, financially successfully and legally securely?, section on invoicing); in this respect, it makes sense to adopt this principle and also classify smaller invoices under 100 euros in this folder (with a consecutive number).

You should also keep a record of your actual income, sorted by time. The mere fact that you have issued an invoice to a customer says nothing about whether the customer has actually paid the invoice amount (in full). For self-employed persons, only the money received in their account (or, in the case of cash payments, the money received in the cash register) is relevant for tax purposes.

In order to be able to fully map the expenditure side, it is necessary that you meticulously collect all receipts (also used synonymously in the following for incoming invoices) for business-related expenses. Every single receipt means hard cash!

As part of the advance VAT return, you will receive the input tax amount contained in the receipts from the tax office as a credit against the VAT payable or even refunded if the expenditure in the relevant period was greater than your income.

As investments are used for longer than just the year of purchase, the legislator has made the system of depreciation binding for all companies. While you have been able to write off capital goods that cost less than 410 euros (individually) (so-called "low-value assets") immediately since 2010, goods that were more expensive must be depreciated over the actual period of use. This means that you spread the net acquisition costs over the years of expected use.

A digital camera (purchase price including VAT, for example, EUR 1,190), which is expected to be used for business purposes for 5 years until it becomes obsolete, is therefore also depreciated over 5 years using the straight-line or declining balance method (usually straight-line, i.e. in equal parts, in this case EUR 200 per year).

The profit determined in the income statement is then the basis for calculating your income tax. If you only do photography on a part-time basis, i.e. if you have other types of income, the profit is included in the sum of your total income, from which the income tax to be paid is then calculated. If you have made a loss, which is not unusual in the first few years of self-employment, this loss will reduce the amount of your total income. In other words, you avoid paying taxes from other types of income.

Please note, however, that the tax office will quickly accuse you of being a "hobby" (i.e. practising photography as a hobby) if you make losses in the field of photography for more than 2-3 years and cannot prove that you are practising photography sustainably to make a profit. In this case, the losses resulting from photography would not be recognized for tax purposes.

Outlook

The average revenue generated from image sales has fallen sharply over the last 10 years. This development is not entirely the fault of the picture agencies, which have been forced to lower their prices due to strong competitive pressure in a global market. There are more and more photos in the stock of photo agencies, which has led to a significant reduction in the proportion of commissioned photography. At the same time, more and more amateur photographers are entering the market, trying to sell their - sometimes fantastic - photos on a part-time basis.

According to a survey conducted by Profifoto magazine in the fall of 2010, 85% of portrait and reportage photographers stated that they were clearly feeling the pressure of competition from amateur photographers. In other words: the pie has gotten smaller, and it is being divided among more photographers than ever before.

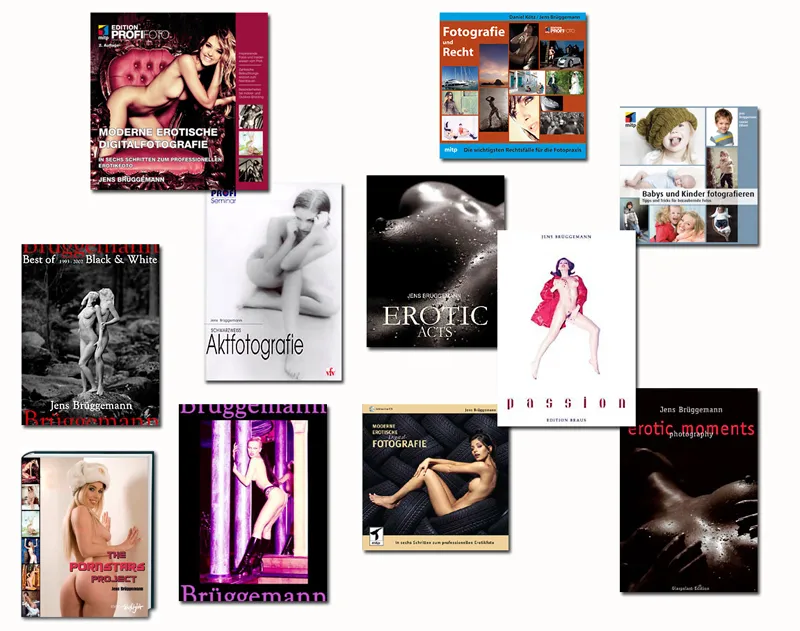

At the weekend or on public holidays, when other people are enjoying their free time, I often compile photos for a photo book or sit at the computer to write a photo textbook. In the course of 12 years in the business, I have now written 10 books on photography.

The system of royalty-free photos has led to the fact that many image users have got it into their heads that photographic services should cost virtually nothing because almost everything is already available to buy as royalty-free image material.

Many photographers are now making the mistake of bowing to this development and are "giving away" their photos or the rights of use to their photos in order to at least be named as the photographer in publications if no fee is paid for them. But this is already the legal situation anyway, and the hoped-for advertising effect is usually zero.

I have already had a number of such requests to make my photos available free of charge to online and conventional publishers so that they can use them in their websites or magazines. In order to generate income. In short: I was supposed to waive my fee (and the models pictured were supposed to waive their model fee) so that the publishers could make a higher profit. What an outrage!

Many clients, but also smaller and medium-sized advertising agencies, are now even taking on simpler or less important photo shoots. For example, many product and people photos are taken by employees who are provided with cameras and accessories specifically for this purpose. In short: such jobs are no longer outsourced to external photographers, but created in-house.

In the medium term, I estimate that up to 50% of conventional photo jobs will no longer be carried out by external photographers, but by other qualified people (often sub-optimally, of course).

Many simple product shots will in future (and in some cases already are) be "co-done" by employees of the advertising company or by employees of the commissioned advertising agency.

Unfortunately, a similar development can also be seen in the field of photojournalism. Journalists, who until recently were solely responsible for the text, are now handed a camera by the editor-in-chief with the request to take a photo "just in case": of the accident, the house fire, the victorious soccer team, the literary figure after the autograph session, the celebrity at the press conference, etc. The press photographer stays at home.

Many local and regional newspapers have also taken to handing out cameras to their reporters so that they can include a photo of the event.

And as if all this isn't bad enough, the German self-proclaimed "Volks-Zeitung" is calling on all readers to go on a photo hunt with their cell phones to earn some pocket money on the side as a "reader reporter" ... As if photographic quality and photographic know-how didn't matter at all.

For those of you who, despite these prospects for professional photographers (which I classify as "modest"), are not deterred from taking the plunge into self-employment, I recommend a visit to the start-up website of the Federal Ministry of Economics and Technology (BMWi). Here you will find lots of important information on procedures, funding programs, financing tips for start-up capital, business plans, checklists for successfully setting up a business and much more.

In order to keep the right overview in the jungle of the many tasks that a business founder has to deal with, we strongly recommend visiting the website www.existenzgruender.de. Here, the Federal Ministry of Economics and Technology provides many valuable tips that are of great help for a successful start to self-employment.

We wish you perseverance, good luck, nice customers and professional success

Jens Brüggemann

Useful links and literature recommendations

- The book "Bildhonorare" by the Mittelstandsgemeinschaft Foto Marketing (MFM), published by the Bundesverband der Pressebild-Agenturen und Bildarchive e.V. (BVPA), is a very good help when calculating offers. It costs 33 euros (together with the handbook "Der Bildermarkt") and can be ordered free of shipping costs directly from the BVPA: www.bvpa.org.

- You can find the legal text on the "VAT small business" section 19 UStG directly on the website of the Federal Ministry of Justice at http://bundesrecht.juris.de/ustg_1980/__19.html.

- The program required for the electronic submission of tax returns, which is also used to transfer data to the tax office, for example for advance VAT returns, can be downloaded at www.elster.de. On the homepage, click on "ElsterFormular", on the following page click on "Download ElsterFormular for 2010/2011>>".

- You can find useful information about photo studies at www.foto-studium.de.

- The magazine PROFIFOTO is not only useful for newcomers, but also for long-time professionals. Every month, it provides an up-to-date look at what is happening in the world of professional photographers and also offers many important (including legal) tips and artistic suggestions. PROFIFOTO is indispensable if you want to look beyond your own nose. www.profifoto.de.

- visuell - Magazin der Bildbranche provides a detailed insight into the picture agency business. Even if the target group tends to be picture editors and managers of picture agencies, photographers who want to devote themselves primarily to stock photography will find many important suggestions here. www.piag.de.

- The well-known magazine Photo Technik International is now simply called Photo International. For friends of good reportage and expressive photos. www.photo-international.de.

- Other notable magazines for professional photography in Germany are digit! and Photo Presse, both available at www.photopresse.de and Photonews (www.photonews.de).

- FreeLens magazine is an absolute must for photojournalists. Info: www.freelens.de.

- The Creative Power 2010 magazine published by New Business Verlag can be browsed online. Here you will find a selection of German communication service providers, i.e. advertising agencies. www.new-business.de.

- The comprehensive handbook from the BFF entitled "Basic Knowledge" is intended for self-employed photographers, students and assistants, representatives and anyone who is already freelance or wants to become self-employed. ISBN 978-3-933989-43-7. approx. 368 pages, 58,- Euro plus 6,- Euro shipping. Available from the Bund Freischaffender Foto-Designer www.bff.de.

- The Federal Ministry of Economics and Technology (BMWi) provides a range of information material for business founders so that they can draw on sound knowledge for a successful start on their way to self-employment. Here you will also find information on funding programs, financing tips for start-ups and for creating a business plan. www.existenzgruender.de.

- The BMWi also provides a free software package "for founders and young companies", which is helpful for drawing up a business plan, but also includes a digital cash book, a strategy planner, a program for income and surplus accounting, etc.: www.softwarepaket.de.

- The authority in Germany for creatives and those looking for (other) creatives in all fields: www.redbox.de.

- Information on the conditions for admission to the Künstlersozialkasse can be found at www.kuenstlersozialkasse.de. You can also download the application form here.

- You can obtain application and representation folders from www.boesner.de and www.monochrom.com.

- Everything possible and impossible about photography, plus numerous tips and lots of useful information, can be found in the Brenner Fotoversandes catalog: www.fotobrenner.de.

- Background and ceiling rail systems from Swiss studio equipment supplier FOBA, for example, can be found at www.profot.de.

- Reference book for the most important legal questions with detailed answers from a lawyer and a summary of each case from a photographer's perspective: "Fotografie und Recht - Die wichtigsten Rechtsfälle für die Fotopraxis" by Daniel Kötz and Jens Brüggemann. 184 pages, mitp-Verlag, 34.95 euros; ISBN: 978-3-8266-5944-7.

- Foto Hamer (headquartered in Bochum) is a large photo retailer in the Ruhr region with several branches. Here, prospective buyers of high-quality cameras and lenses have the opportunity to try them out in a rental studio just 30 meters away before buying. The same naturally applies to studio flash systems and other accessories. www.foto-hamer.de.

- "Ratgeber Freie - Kunst und Medien" is a project of the Vereinte Dienstleistungsgesellschaft ver.di. Here you can find the book of the same name by Goetz Buchholz in digitalized form and constantly updated. www.ratgeber-freie.de.

- "Success as a photographer - How to present your skills in the best possible way" promises Dr. Martina Mettner in her book of the same name. My impression: It would have been nice if the author had addressed many points more specifically. Nevertheless recommendable. ISBN: 978-3-9813869-0-5. 216 pages, 39.80 euros.

- Calumet ("It's where the Pros go") should be known to anyone who wants to take professional photographs. The pre-selected selection of high-quality photographic equipment for everyday professional use combined with the best advice promises a satisfied regular customer base. Simply contact the sales team: e.g. michael.roll@calumetphoto.de.

- Flyers and other advertising materials can also be ordered very cheaply on the Internet, for example at www.flyerpilot.de. However, if you need very high-quality printed matter where you may want to be present at the printing press to monitor the print quality, the best way is of course still to commission a local print shop.

- For example, www.druckverlag-kettler.de produces very high-quality printed matter such as art books and art catalogs.

- Here you can see if the desired domain name is still available: http: //www.denic.de/domaincheck.html.

- If you want to find out who is responsible for a particular website, you should visit http://www.whois.net.

- To check whether you are infringing existing trademark rights when choosing your domain name, you should visit http://www.wipo.int/ipdl/en/suche/madrid/suche-struct.jsp before reserving the domain name. The WIPO is an office for the registration of international trademarks, the German equivalent is the website http://register.dpma.de/DPMAregister/marke/einsteiger of the German Trademark Office.

- You can find the application for a VAT identification number at the web address https://www.formulare-bfinv.de (menu item: Assignment of a VAT ID).

- Photographers and photo designers are compulsory members of the Employers' Liability Insurance Association for Energy, Textile, Electrical and Media Products (branch administration for printing and paper processing). You can find out more and register here: www.bgdp.de or www.bgetem.de.

- You can find the Association of German Chambers of Industry and Commerce (DIHK) at www.dihk.de.

- You can find tips on Germany as an investment location and on setting up a company at www.gtai.com (Germany Trade & Invest).

- Information on the "master craftsman requirement" and the possibility of becoming self-employed as a photographer as a career changer, also in the context of the last decades, can be found on the website "Possibilities of self-employment in the photographic sector" by the lawyer David Sailer: www.fotorecht.de/publikationen/meister.html.

- Before concluding a rights administration agreement with VG Bild-Kunst, it is best to inform yourself online at www.bildkunst.de.

- Private photography schools in Germany (listed alphabetically by city name):

- Design Akademie Berlin: www.design-akademie-berlin.de

- Lette-Verein Berlin: www.lette-verein.de

- New School for Photography Berlin: www.neue-schule-berlin.com

- Ostkreuzschule for Photography and Design Berlin: www.ostkreuzschule.de

- Photoacademy Urbschat Berlin: www.photoacademy.de

- Best Sabel Education Center Berlin: www.best-sabel.de

- Free Academy of Fine Arts Essen: www.studium-fotografie.de

- Lazi Academy Esslingen: www.lazi-akademie.de

- Photo Academy Cologne: www.fotoakademie-koeln.de

- Photo+Medienforum Kiel: www.photomedienforum.de

- Private School for Photo Design Pforzheim: www.foto-design-schule.de

- Universities in Germany (sorted alphabetically by city name):

- Aachen University of Applied Sciences: www.fh-aachen.de

- Augsburg University of Applied Sciences: www.hs-augsburg.de

- Berlin University of the Arts: www.udk-berlin.de

- btk Berlin University of Applied Sciences: www.btk-fh.de

- Berlin University of Applied Sciences for Technology and Economics: www.kd.fhtw-berlin.de

- Berlin-Weißensee School of Art: www.kh-berlin.de

- Bielefeld University of Applied Sciences: www.fh-bielefeld.de

- Braunschweig University of Art: www.hbk-bs.de

- Bremen University of the Arts: www.hfk-bremen.de

- Darmstadt University of Applied Sciences: www.fbg.h-da.de

- Dortmund University of Applied Sciences and Arts: www.fh-dortmund.de

- Dresden University of Technology: www.arch.tu-dresden.de

- Düsseldorf University of Applied Sciences: www.fh-duesseldorf.de

- Düsseldorf Institute for Music and Media: www.rsh-duesseldorf.de

- University of Wuppertal: www.uni-wuppertal.de

- University of Duisburg - Essen: www.uni-duisburg-essen.de

- Frankfurt State University of Art and Design: www.staedelschule.de

- Burg Giebichenstein, Halle: www.burg-halle.de

- Hamburg University of Fine Arts: www.hfbk-hamburg.de

- Hamburg University of Applied Sciences: www.haw-hamburg.de

- Hanover University of Applied Sciences and Arts: www.fh-hannover.de

- Hildesheim University of Applied Sciences and Arts: www.hawk-hhg.de

- University of Hildesheim: www.uni-hildesheim.de

- Karlsruhe University of Arts and Design: www.hfg-karlsruhe.de

- Kassel University of the Arts: www.kunsthochschulekassel.de

- Kiel Muthesius University of Fine Arts and Design: www.muthesius-kunsthochschule.de

- Cologne International School of Design: www.kisd.de

- Cologne University of Applied Sciences: www.fo.fh-koeln.de

- Academy of Media Arts Cologne: www.khm.de

- Konstanz University of Applied Sciences: www.htwg-konstanz.de

- Niederrhein University of Applied Sciences Krefeld: www.hs-niederrhein.de

- Leipzig University of Applied Sciences for Graphic Arts: www.hgb-leipzig.de

- Mainz University of Applied Sciences: www.fh-mainz.de

- Johannes Gutenberg University Mainz: www.kunst.uni-mainz.de

- Academy of Fine Arts Mainz: www.afbk-mainz.de

- Mannheim University of Applied Sciences: www.hs-mannheim.de

- Munich University of Applied Sciences: www.hm.edu

- Academy of Fine Arts Munich: www.adbk.mhn.de

- Münster University of Applied Sciences: www.fh-muenster.de

- Georg Simon Ohm University of Applied Sciences Nuremberg: www.ohm-hochschule.de

- Offenbach University of Art and Design: www.hfg-offenbach.de

- University of Osnabrück: www.uni-osnabrueck.de

- Ottersberg University of Applied Sciences: www.fh-ottersberg.de

- Potsdam University of Applied Sciences: www.design.fh-potsdam.de

- Saarbrücken University of Fine Arts: www.hbksaar.de

- Schwäbisch Hall University of Applied Sciences: www.fhsh.de

- University of Siegen: www.kunst.uni-siegen.de

- Merz Academy Stuttgart: www.merz-akademie.de

- State Academy of Fine Arts Stuttgart: www.abk-stuttgart.de

- European Academy of Fine Arts Trier: www.eka-trier.de

- Bauhaus University Weimar: www.uni-weimar.de

- Wiesbaden University of Applied Sciences: www.fh-wiesbaden.de

- Wismar University of Applied Sciences: www.hs-wismar.de

- Würzburg University of Applied Sciences: www.fh-wuerzburg.de